Mortgage Pre-Approval vs Pre-Qualification

Edited 11:14a 5/27 – It is important to know that some lenders use these terms interchangably. The most import part, so that the information has better accuracy, is when the lender reviews the income, assets and full credit report.

When you’re considering buying land, understanding the difference between a mortgage pre-qualification vs pre-approval for a land loan can dramatically influence your strategy. These steps serve different purposes and can position you very differently in the eyes of sellers. So, whether you’re eyeing a parcel for investment, future development, or building your dream home from the ground up, let’s explore how each process works—and why it matters.

Understanding Land Financing Basics

Financing land isn’t quite the same as financing a traditional home. While both typically involve lenders and loan applications, land loans often come with stricter qualifications, larger down payments, and higher interest rates.

Because of these nuances, it’s crucial to get clarity upfront. This is where pre-qualification and pre-approval step in, helping you and potential sellers assess your financial credibility before making moves on a property.

What is Pre-Qualification?

Pre-qualification is an informal first step in your financing journey. It involves sharing estimated financial information—like income, debts, and savings—with a lender. Based on that, they’ll offer a rough estimate of how much land you might be able to afford.

No paperwork. No hard credit checks. Just a simple conversation or online form submission to get a financial snapshot. This makes pre-qualification ideal for scoping out land prices and getting a sense of your options early on.

What is Pre-Approval?

Pre-approval, on the other hand, is a formal and more involved process. It includes a hard credit inquiry and requires documented proof of your income, debts, assets, and employment. The lender reviews all this to issue a conditional commitment on the amount they’re willing to lend you for purchasing land.

Getting pre-approved for a land loan can be more complex than for a home mortgage. Lenders often scrutinize the intended use of the land (residential, agricultural, recreational, or commercial) and whether it has road access, utilities, or zoning restrictions.

Pre-Qualification vs Pre-Approval: A Side-by-Side Comparison

| Feature | Pre-Qualification | Pre-Approval |

|---|---|---|

| Speed | Fast (minutes to hours) | Slower (days to a week) |

| Credit Check | Soft inquiry (no impact) | Hard inquiry (may impact score) |

| Documentation | Self-reported info | Verified financial documents |

| Lender Commitment | None | Conditional loan offer |

| Usefulness in Bidding | Minimal | Highly valuable |

| Accuracy | Approximate estimate | Precise calculation |

When Should You Get Pre-Qualified?

If you’re just starting to explore the idea of buying land, pre-qualification is a great first move. It gives you a ballpark budget range without diving into paperwork. It’s helpful for:

- Casual land shoppers

- Comparing rural vs. urban lot prices

- Understanding your borrowing power early on

When is Pre-Approval the Better Choice?

If you’ve identified a specific plot of land—or are actively bidding—pre-approval strengthens your position. It tells sellers you’ve already cleared the lender’s initial checks. Especially for high-demand lots, pre-approval gives you a significant advantage.

Benefits of Mortgage Pre-Qualification

- Quick feedback for early planning

- No credit impact

- Useful for budgeting across different types of land

- Flexible estimates without documentation hassle

Drawbacks of Pre-Qualification

- Not binding in any way

- Based on unverified info

- May lead to underestimating actual land loan needs

Advantages of Getting Pre-Approved

- Credible buyer status for landowners or agents

- Faster final loan approval once you make an offer

- More realistic budgeting based on verified financials

- Builds trust when dealing with real estate developers or private sellers

Limitations of Pre-Approval

- Requires full financial disclosure

- Hard credit check might lower score slightly

- Valid for a limited time (often 60–90 days)

Key Documents for Pre-Qualification

- Income estimates

- Debt overview

- Property use intent (optional)

- Estimated land cost or range

Required Paperwork for Pre-Approval

- W-2s or tax returns

- Recent pay stubs

- Bank and investment statements

- ID documents

- Land-use plans or documents (if requested)

How Credit Score Impacts Both Processes

For land loans, a higher credit score (typically 680+) is often required. While pre-qualification may skip the check, pre-approval will involve a thorough credit review. Strong credit improves your chances of approval and favorable rates.

Understanding Soft vs Hard Credit Pulls

Soft pulls (used in pre-qualification) don’t hurt your credit score. Hard pulls (used in pre-approvals) can drop your score by a few points but are necessary to obtain a serious offer from lenders.

The Role of Debt-to-Income Ratio

DTI ratios are crucial, even for land loans. Most lenders want your total debt payments to stay under 43% of your income. A lower DTI can also help offset riskier land investments.

How Long Does Each Process Take?

- Pre-qualification: 10–30 minutes

- Pre-approval: 3–7 business days, especially if zoning or land-use plans need review

Validity Period of Pre-Qualification and Pre-Approval

- Pre-Qualification: Informal, can refresh monthly

- Pre-Approval: Typically valid for 60–90 days

Can You Be Denied After Pre-Approval?

Yes. Even with pre-approval, things like:

- Land failing an appraisal

- Zoning issues

- Title disputes

can derail final approval. Stay cautious and consult professionals.

How Lenders View Each Process

Pre-qualification is an entry point; pre-approval is a commitment. When it comes to buying land, lenders will assess risk more strictly, especially for undeveloped plots.

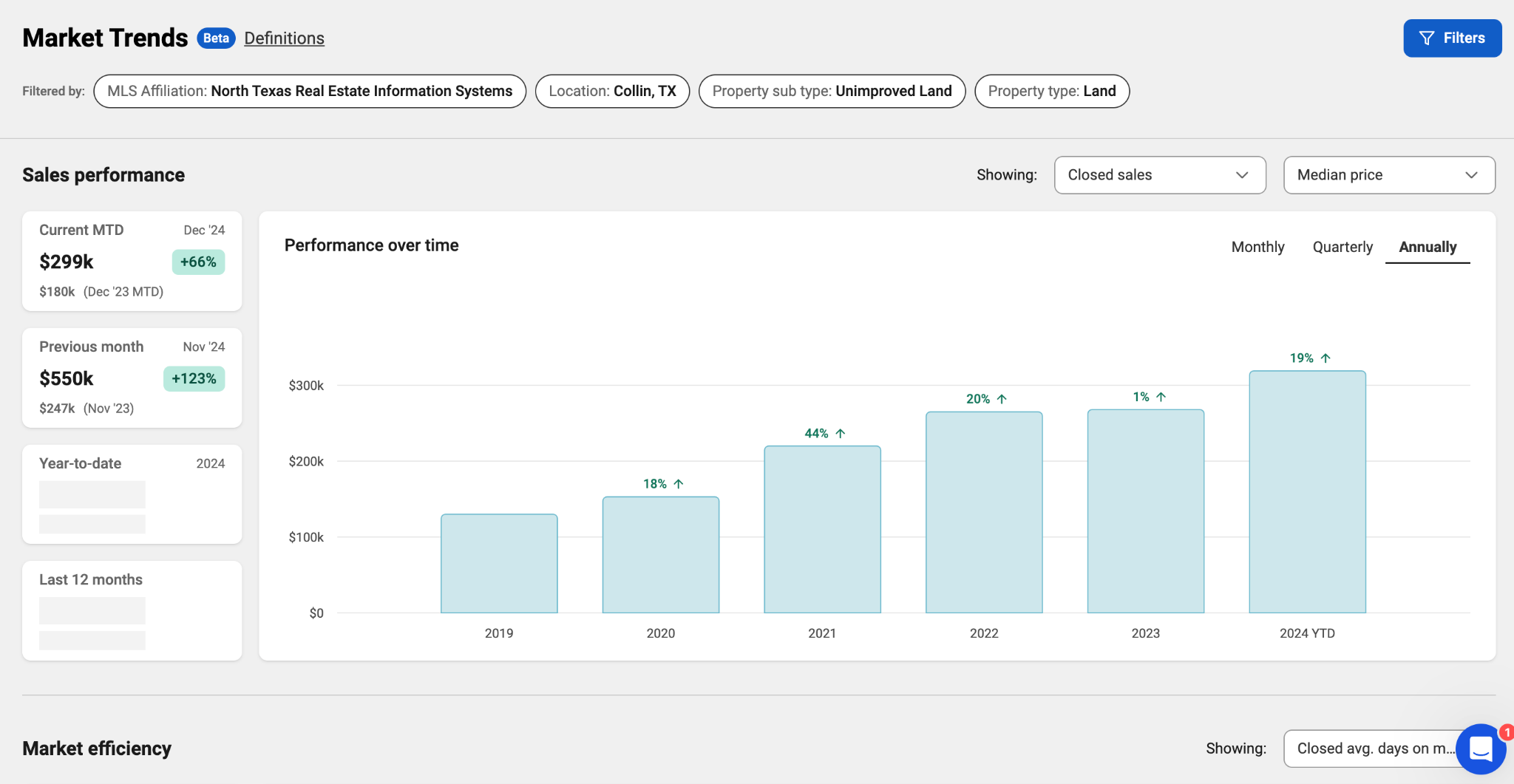

Market Conditions and Their Impact

In competitive land markets, pre-approval can make or break a deal. In remote or less-demand markets, sellers may be more flexible—but it’s always wise to prepare.

Does One Make You a Better Buyer?

Absolutely. Pre-approval signals you’re financially ready, making you a more attractive buyer to landowners and agents. It can help seal deals faster, especially for vacant land under development pressure.

How First-Time Land Buyers Should Approach It

Start with pre-qualification to gauge your purchasing power. Then get pre-approved before making any offers, especially on land with unique zoning or access requirements.

What Realtors Think About Each

Land-focused realtors often prefer working with pre-approved buyers, especially for plots requiring development, zoning verification, or environmental assessment.

Digital vs In-Person Processes

Online lenders and rural credit unions often offer digital pre-qualification. For pre-approval, expect more in-person or phone communication, especially for non-standard land deals.

Using Mortgage Brokers vs Direct Lenders

- Brokers: Best for shopping rates or unique land-use cases

- Direct lenders: Good for faster approvals on conventional plots

- Both have their strengths depending on the land’s purpose

What Happens After Pre-Approval?

You move into final underwriting. The lender confirms property details like access roads, utility setup, and zoning laws before issuing final approval.

Cost Implications of Both Options

- Pre-qualification is free

- Pre-approval may involve fees: application, credit report, or appraisal

- Land appraisals can be pricier than home appraisals

Should You Do Both?

Yes! Use pre-qualification to research. Use pre-approval when you’re ready to buy. It strengthens your position and saves time in closing.

Mistakes to Avoid with Pre-Qualification

- Overestimating your affordability

- Not researching land zoning restrictions

- Assuming it guarantees a loan

Mistakes to Avoid with Pre-Approval

- Providing outdated or incorrect documents

- Making large financial changes before closing

- Ignoring land-specific lender requirements

FAQs

Is pre-approval better than pre-qualification for buying land?

Yes. It provides more credibility and clarity for both you and the seller.

Can I get pre-approved if I’m buying raw land?

Yes, but expect stricter requirements like higher down payments and verified land use.

Will pre-qualification hurt my credit score?

No, because it typically involves a soft pull or no credit check.

Can I be denied after pre-approval?

Yes. Issues with zoning, appraisal, or financial changes can still cause denial.

How long does pre-approval last for land purchases?

Typically 60–90 days. Check with your lender for specific expiration timelines.

Do land loans have higher interest rates?

Yes, they often do—especially if the land is raw or lacks access/utilities.

When buying land, knowing the difference between pre-qualification and pre-approval isn’t just helpful—it’s empowering. Each step serves a purpose in securing financing and showing sellers you’re ready to commit. While pre-qualification helps you explore, pre-approval prepares you to purchase. For a smooth path to land ownership, use both strategically.

When looking to buy land check out our recent blog on Tips to Buying Land.

A great source of information when you are wanting to purchase land to farm USDA Grants & Loans